Menu

Everyone creates a retirement corpus to get a regular flow of funds from the beginning to the end of the post-retirement phase. We estimate certain fixed fund flow from this corpus, as a replacement for our salary, supposing it to remain adequate throughout the post-retirement phase. But, we forget to notice the incremental rise in our salary, countering the inflation right from the beginning. This regular increase of funds had been protecting us from the heat of inflation. However, in the absence of incremental rises, the fund starts falling short as we move further in the post-retirement phase.

But, we must recognize the fact that living expenses are bound to increase under inflation even after retirement. In the absence of an incremental rise, a steady stream of funds will slowly become insufficient. Initially, we carry a false impression of this being sufficient, but once the purchasing power drops substantially, it becomes difficult to manage. The situation becomes worst if any financial emergency pops up.

As a result, retirees start facing difficulty to manage their living expenses at a little later stage of their retirement.

The root cause –

While creating the retirement corpus, we focus on creating a decent corpus that can supply a fixed fund flow throughout the post-retirement phase. However, the financial security of the post-retirement period is not all about getting a fixed stream of the fund but getting a fixed purchasing power. The inflation pushes our expenses every year and after few years, the same fund flow which was adequate becomes inadequate.

Our Reaction & its Consequences –

Initially, the gap between fund demand & supply is normally managed by cutting down the non-essential expenses. But, over a period of time, this gap widens further and triggers financial crises.

To overcome this, we react & adopt one of these three options –

The result – Corpus starts depleting, resulting in a continuous drop in regular fund supply from the depleting corpus & we are trapped into a free fall cycle till the corpus exhausts.

The result – This compromise continues increasing with time, beginning with non-essentials but slowly moving to essentials. We end up reaching a stage when we have no choice but to start consuming corpus.

The result – Initially, we might be able to bridge the gap but slowly the additional income might not be enough to bridge the widened gap. Moreover, restart after a long gap may also pose many limitations like obsolesce, physical limitation etc.

Irrespective of the option selected, the fear of drying out the regular fund flow before time creates tremendous mental stress. The dream of leading a stress-free & peaceful second innings remains unfulfilled.

Example –

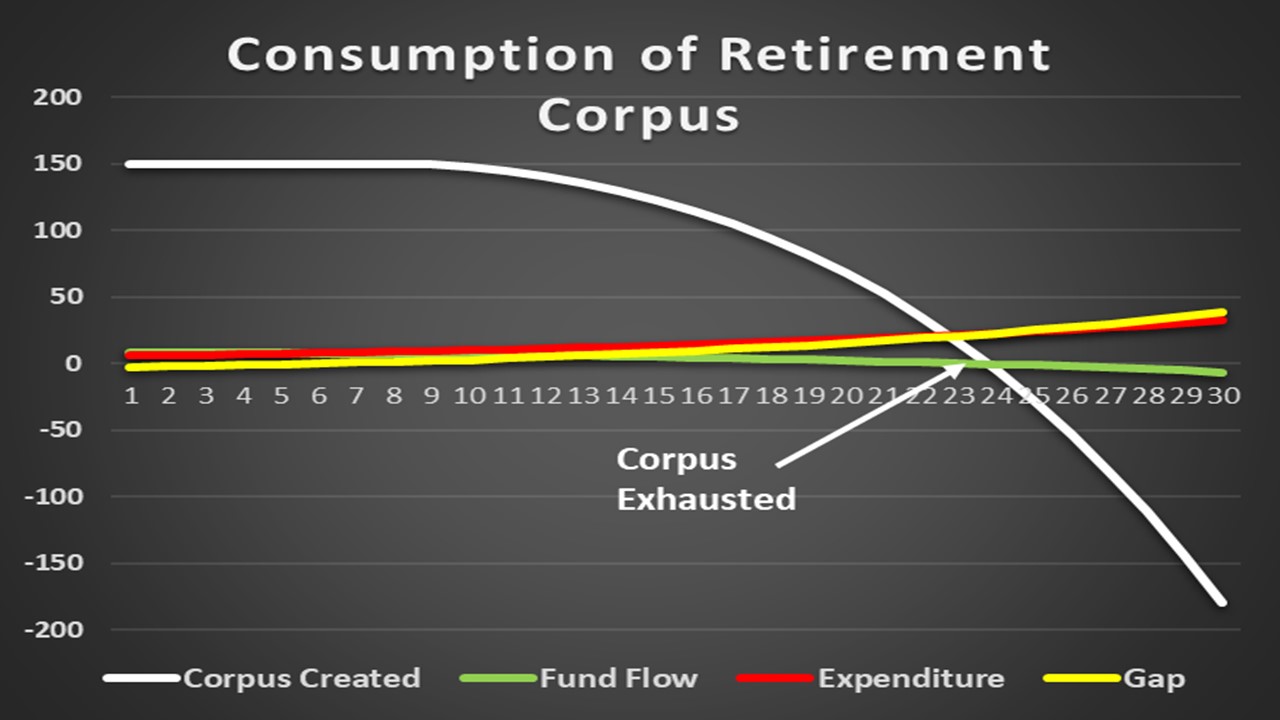

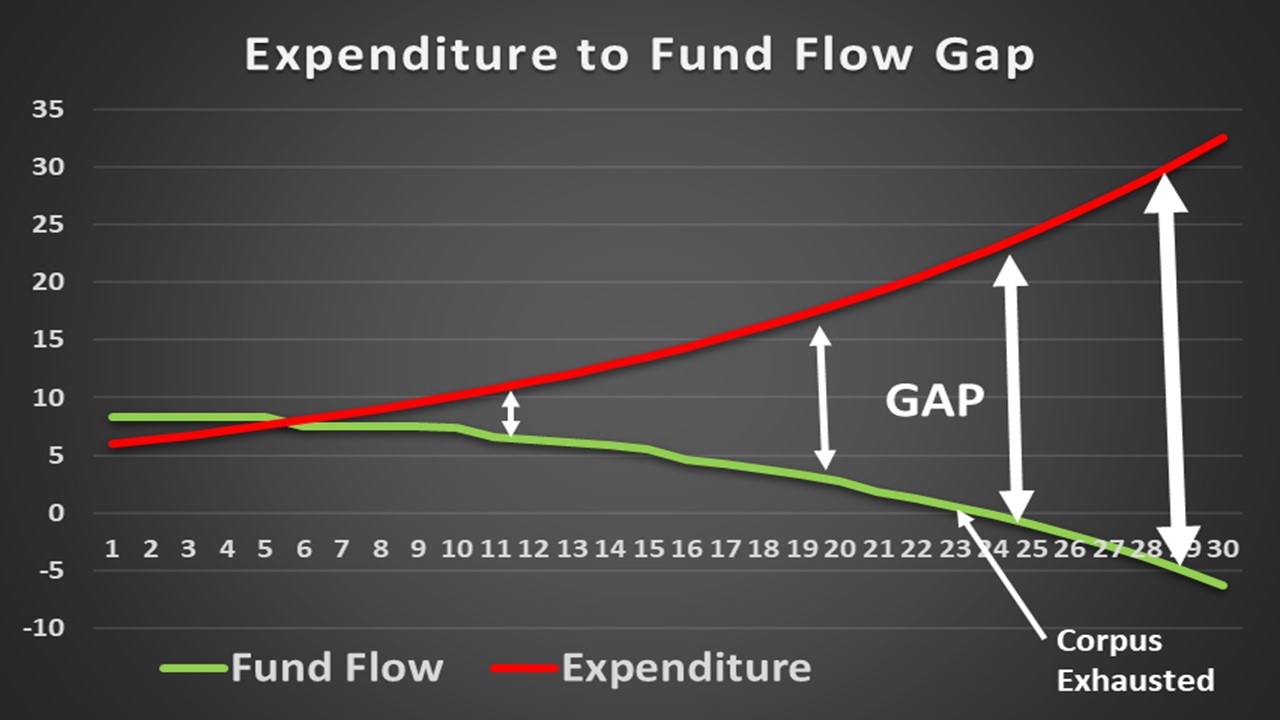

A corpus of Rs. 1.50 Cr. is created to support & sustains the living expenses of Rs. 50,000/ per month. The corpus is invested in bank/ post office deposits. Initially, for few years, the returns were adequate to meet the expenses. Over a period, expenses continued increasing under inflation, whereas interest rates continued falling.

Corpus consumption started to bridge the gap that further reduced the deposit’s interest. The corpus continues thinning & finally, neither the corpus nor its returns existed.

This is illustrated graphically for better clarity.

What is the solution –

While estimating your retirement corpus, focus on monthly fund demand to manage your living expenses. The monthly requirement of funds shall be inflation-adjusted. The fund demand, in turn, shall dictate the required corpus. Jumping directly to the corpus size without accounting for this fund demand can go erroneous. A detailed retirement planning can estimate the corpus precisely. A basic understanding of financial aspects can help to prepare a detailed retirement plan. This understanding will also help to manage the corpus efficiently in the post-retirement phase.

Normally a large corpus is perceived to be adequate but, it may not be true always, it is the returns that bring financial security. Therefore, it is corpus investment that holds the key. A fund-flow chart from the beginning to the end of the retirement period could be helpful to maintain financial security.

Certain aspects like life expectancy, relevancy of post-retirement expenses, lifestyle-related expenses, inflation etc., must be considered in retirement planning to estimate a practical corpus. Such aspects shall be discussed in upcoming blogs.

Conclusion –

A regular fund flow to manage post-retirement living expenses is an essential part of retirement planning. A basic understanding of financial aspects can help estimate adequate corpus & logical/systematic withdrawal plans. The corpus size shall be adequate to facilitate inflation-adjusted withdrawals for the entire post-retirement phase.

Now the concept of living expenses is not limited to day to day expenses only but has become much broader. It is no more a submissive lifestyle that we all want to have but an enthusiastic beginning to enjoy the golden years. To achieve this, we must be financially secured and having enough disposable funds to do what we enjoy.

All Rights Reserved By ManishMantra.com