Menu

The basic objective to buy a Life insurance policy is to provide financial security in event of the demise of an insured member. This is achieved by insuring the financial liabilities that an earning member is expected to deliver over his/ her entire earning phase. The policy is expected to compensate the loss of earnings, in event of loss of life, during the policy tenor (against the death benefit). Therefore, it is a PROVISION (made against loss of futuristic income), and shall NOT be treated as an investment (which is to earn returns).

When trying to evaluate this, due to the expectation of direct returns, our selection tends to be biased. For example, Hybrid life insurance policies, offering returns in addition to life insurance, have become very popular because of such features. Our inclination to earn returns, under lucrative offers, easily diverts our focus from ‘building a provision’ to ‘earn returns’.

Since investment & insurance have different objectives and when we attempt to derive both the benefits from one financial product, we end up compromising on both fronts. To avoid this, all the options need to be evaluated for the objective to be achieved.

This blog deliberates how the available options shall be evaluated to select the right one.

Let us take a case, where we want to evaluate two available options to select the right one for us;

– Your age – 40 Years

– You are looking for a coverage of Rs. 50 Lakh i.e. Sum Assured (SA) = Rs. 50 Lakh.

– The policy term you want – 20 Years.

Option 1 – Insurance cum investment policy (Endowment Policy)

– Premium per year = Rs. 2.4 Lakh (This can vary with insurer/ policy type)

– Financial benefits, as per policy document –

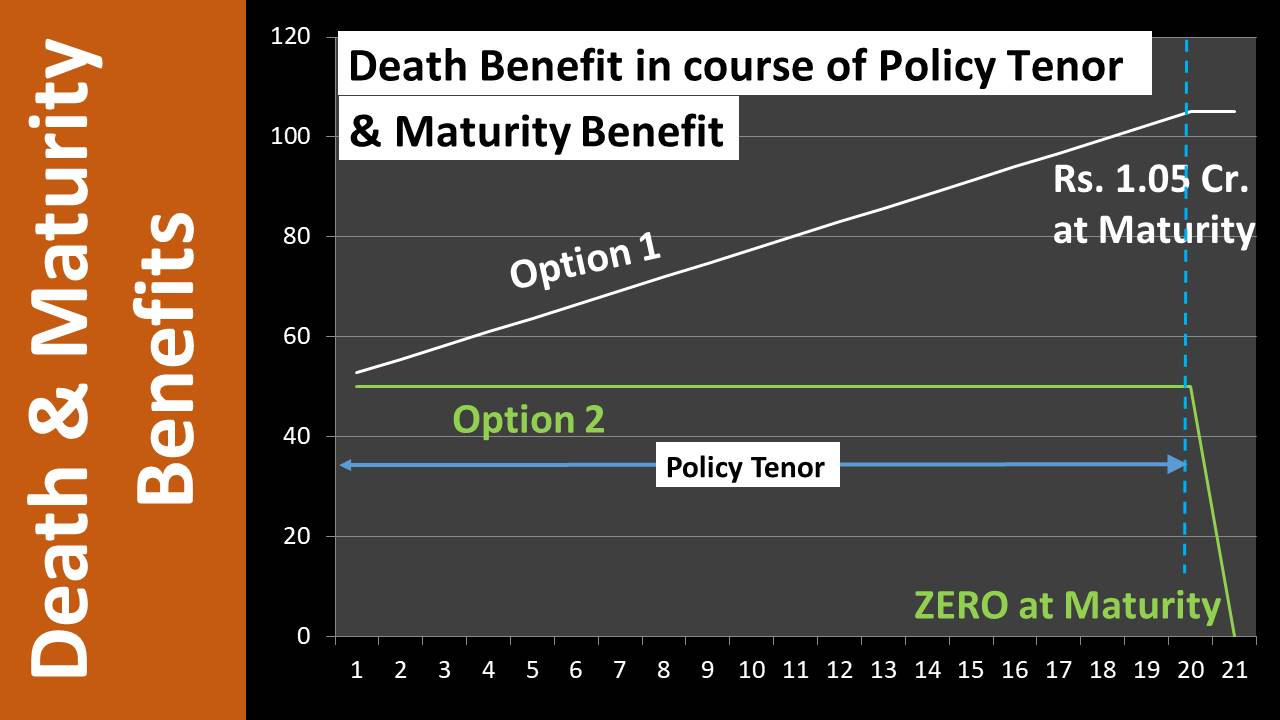

– Death Benefit – During Policy Tenor = Rs. 50 Lakh + Applicable Bonus

– Maturity Benefit – Rs. 50 Lakh + Accumulated Bonus (say @ Rs. 55 Lakh) = Rs. 1.05 Cr.

Option 2 – Term Insurance’ policy

– Premium per year = Rs. 15,000 (This can vary with insurer/ policy type)

– Financial benefits as per policy document –

– Death Benefit – During Policy Tenor = Rs. 50 Lakh

– Maturity Benefit – ZERO

Now, the most common parameters we look for –

– Premium

– Death Benefit

– Maturity benefit

Option 1 | Option 2 | |

Premium | Rs. 2.40 Lakh/ Year | Rs. 15,000 / Year |

Death Benefit | SA – Rs. 50 Lakh + Rs. 2.75 Lakh/ Year | SA – Rs. 50 Lakh |

Maturity Benefit | SA – Rs. 50 Lakh + Accrued bonus Rs. 55 Lakh | NIL |

Now if we look at it solely from the point of view of financial benefit, option 1 appears to be an obvious choice, but when compared to the premium paid every year, option 2 looks more attractive.

Option 1 involves paying almost 16 times the premium when compared to option 2. The additional financial benefits derived from option 1 have got a cost attached to it, in terms of excessive premium.

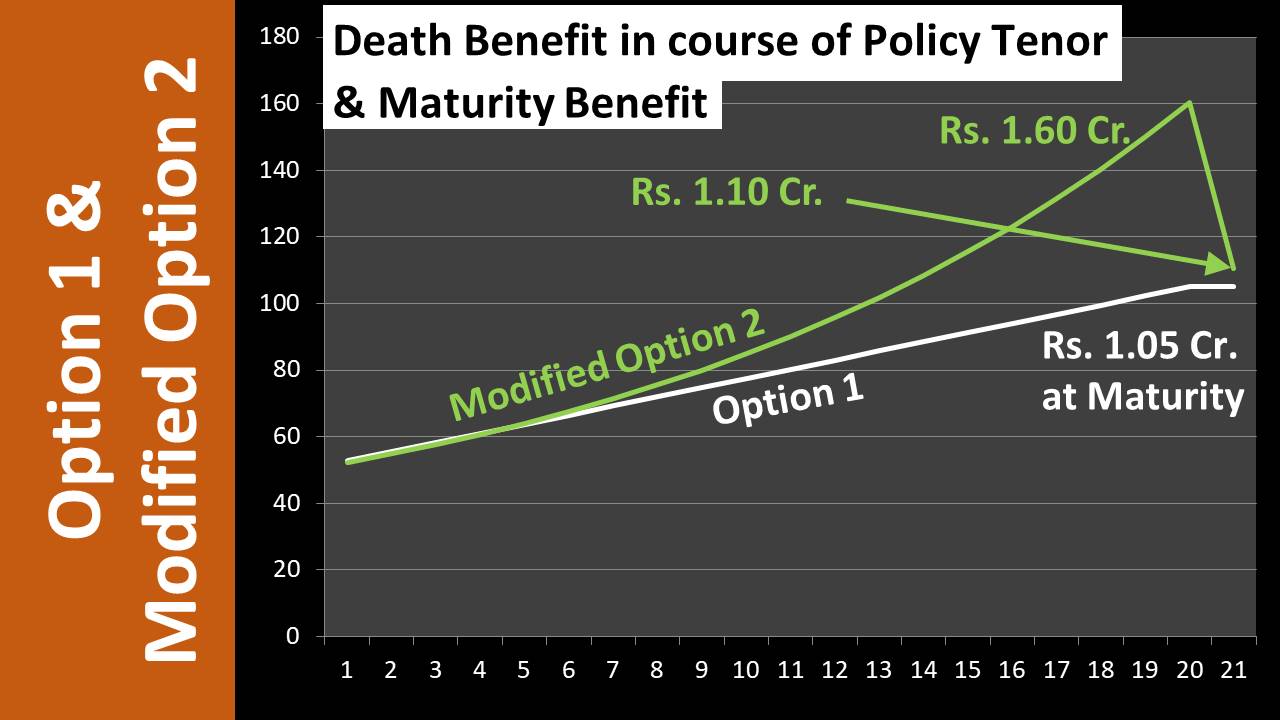

To have, apple to apple comparison, let us invest this differential fund of Rs. 2.25 Lakh per year, to a pure investment option. Let us assume a conservative growth of 8% per year on this investment.

This investment also grows parallel to policy progress as the premium saved continued to be invested. This model, having term policy and investment on two different platform is a modified version of Option 2 – let us call it as modified option 2.

| Option 1 | Modified Option 2 |

Premium | Rs. 2.40 Lakh/ Year | Rs. 15,000 / Year |

Investment | NIL | Rs. 2.25 Lakh / Year |

Death Benefit | From Investment – NIL | From Investment – Compounded growth of Rs. 2.25 Lakh/ year |

From Policy – | SA – Rs. 50 Lakh | |

Maturity Benefit | From Investment – NIL | From Investment – Rs. 1.10 Cr. |

SA – Rs. 50 Lakh + Accrued bonus Rs. 55 Lakh | NIL |

By equalizing the fund outflow per year, we can compare both the benefits i.e. death benefit & maturity benefit. The comparative growth of both the options in the graph shows that –

1) First 5 years – It is almost equal.

2) From 6th Year to 20th Year – Financial benefit from modified option 2 is always exceeding that from option 1.

1) Option 1 – Rs. 1.05 Cr.,

2) Modified Option 2 – Rs. 1.10 Cr. i.e. modified option 2 is marginally exceeding option 1.

This shows –

Separating insurance & investment not only improves the death benefit but also maintains the maturity benefit. On the other had, mixing both is not giving any extra ordinary benefit.

But still, the most important question that needs to ask from our-self –

– Is the coverage of Rs. 50 Lakh adequate?

– Will the death benefit be adequate to give financial security to our family?

The answer to these two questions brings out the most important aspect of any life insurance policy i.e. adequacy of the financial coverage offered by the policy.

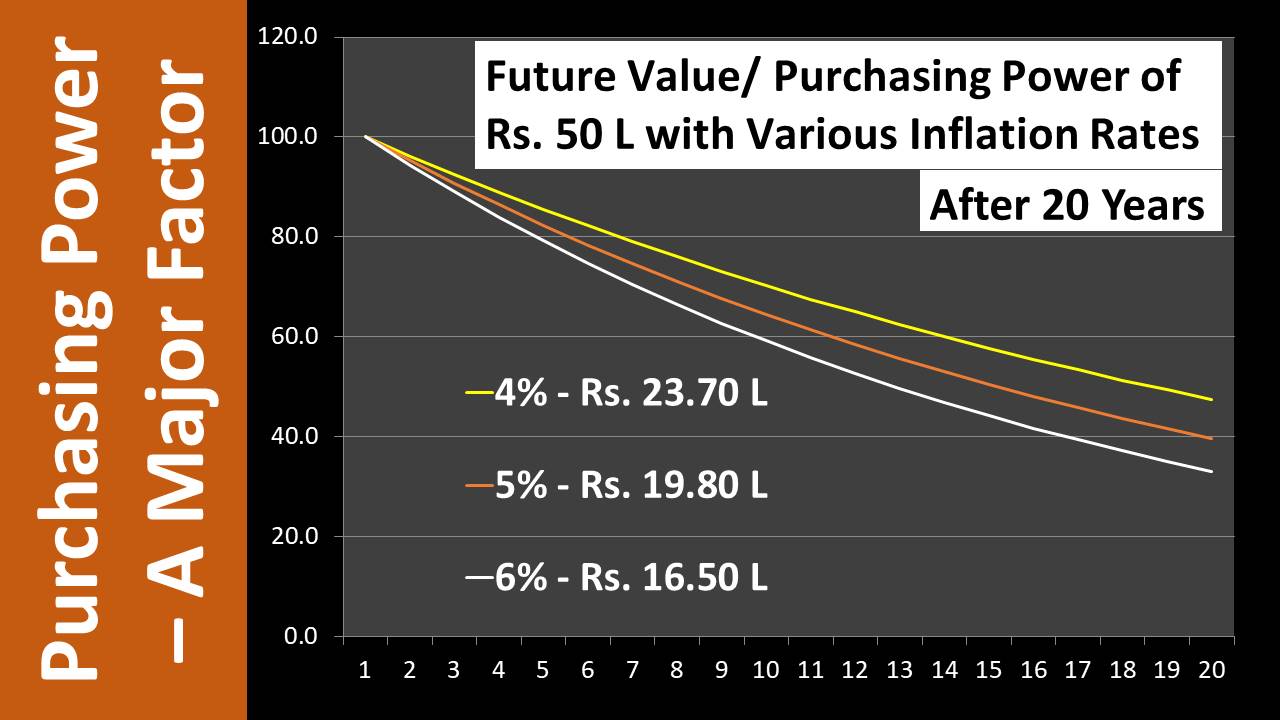

Coverage can be considered to be adequate, only if the fund is capable of providing financial security at the point of delivery. Since the deliveries are in future, it is the future value (i.e. purchasing power of rupee), that is important, not the current value. Since a substantial part of growth/ bonus is sacrificed on inflation, the focus shall be on the purchasing power of money not on the absolute value.

Therefore, adequacy of the coverage is the most important aspect of any life insurance policy. Insuring with inadequate coverage is not a justice to our family.

The coverage value can’t be a random number but shall be determined considering future liabilities/ expenditures. This aspect shall be discussed in the upcoming blog to understand how insurance coverage value shall be estimated.

Conclusion

The life insurance policy should never be selected based on direct returns but should be dictated by the desired financial coverage. A plain policy, offering adequate coverage, serves the purpose but when integrated with returns expectations, it deviates from its basic objective. Separating insurance & investment can give better results if available options are analyzed thoroughly before adoption.

All Rights Reserved By ManishMantra.com