Menu

The phenomenal rise in higher education expenditure has forced everyone to pull up their socks to prepare for this liability well in advance. Being forced to compromise on your child’s education because of financial trouble puts parents in a very tight spot indeed. Consequently, they prepare for most of their earning life to build out a pool of funds that they can withdraw from, despite financial adversity. However, this might or might not be enough for when the admission season rolls in.

We shall be discussing here, how to avert this situation.

When dealing with long-term financial goals, the most important aspect is to identify/ recognize and bridge gaps developed during the course of this journey. The pool of funds is not created just for the sake of achieving the fund value but also to ensure financial adequacy to meet the goal.

To achieve this, we need to ensure the following 7- essentials.

The purpose of creating this fund is to meet the financial demand of the intended course of study and hence the prime objective is to ensure it is adequate with respect to your anticipated fund. Therefore the estimation of the demand must be accurate.

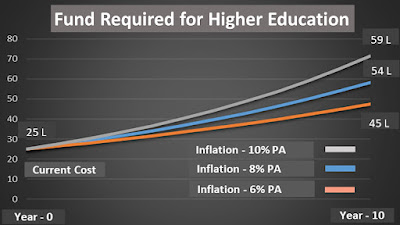

Setting a fund value randomly or by a “gut-feeling” will most definitely not give you the right information to crunch the numbers, but taking a more scientific approach (by including a broader factor such as inflation) will definitely lead you towards a more reasonable number.

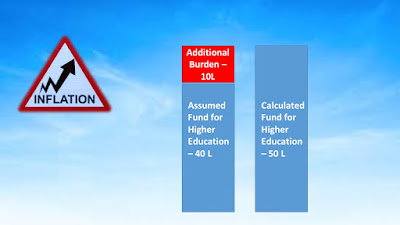

For example, you might assume that 10 years from now, paying for your child’s engineering college degree might cost you, say 40 Lakhs since it costs around 25 Lakhs currently. But a random projection doesn’t help you prepare well for this. However, taking a more scientific approach to this and understanding all the factors involved in calculating such costs might help you reach a more accurate number.

The normal tendency of calculating future value is using general inflation. Future values calculated by using this inflation may not reveal the sector-specific requirements but, in fact, mislead. Thus its always important to use appropriate sector-specific inflation to estimate future value. These inflation values may not be available outright but can always be fetched with a little research. General inflation contains various heads, having diverse weights and hence to calculate, for example, inflation related to the education sector, the inflation rate is ~8% while the general inflation rate is ~5%.

Making investments to pursue a fund value is not enough. It’s a dynamic world and hence projected growth of any investment keeps on changing from time to time. Thus acknowledging such changes & adopting appropriate actions can help prevent last-ditch surprises. Keeping our eyes & ears open to incorporate such changes in our planning can prevent last-minute surprises. A passive attitude leaves no time for corrections.

For example, changes in the rate of inflation, the stream of education, taxation on maturity, etc. do happen over time. Such changes have a direct impact on our target as well as on grown funds and hence appropriate corrections need to be adopted to bridge the gap.

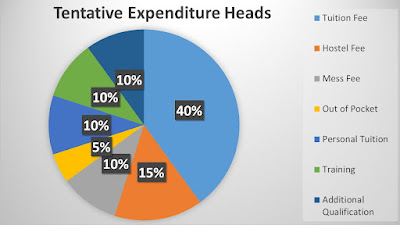

While estimating the outlay for higher education, we focus only on a few standard heads e.g. tuition fee, hostel fee, mess fee, out-of-pocket expenditure etc. However, when courses are pursued, you might incur expenses in other areas, such as private tuitions, training, extracurricular activities, additional qualification, etc. Moreover, some more expenses might rack up when your child actually starts university. A provision for such expenditure also needs to be accounted for while planning

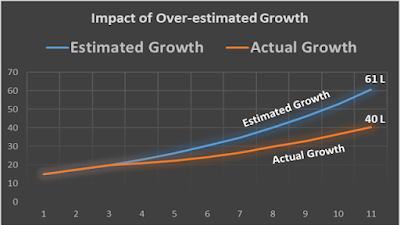

While investing to create any fund, we remain very optimistic and hence we take current growth rates or short term growth rates in our calculation. But future growth may or may not follow a historical trend because the financial world is dynamic. Hence, extrapolating current or short-term returns to long-term returns may give you a surprise or a nasty shock. Look for long term consistency and have realistic expectations. This will help you navigate to a more reasonably accurate investment required to achieve your target corpus.

For example – Currently, PPF returns are close to 8%, but they may not persist at the same rate for the coming 10 years. Similarly, mutual funds might have given over 15-20% returns in the past year but may not continue on the same lines for the next 10 years. Hence, you should expect realistic returns considering all such factors.

We normally forget the impact of taxation on returns. At the most, we consider the current taxation structure for future proceeds. But taxation is not an exception to the ever-changing world of finance. Every union budget brings forth a change here and there to existing laws and by the time we aim to withdraw our proceeds, this could possibly have been through many iterations of changes. Thus, many changes are inevitable till our investment reaches its destination. Maturity proceeds may or may not remain tax-exempt, current tax rates on maturity may not remain the same, our own personal tax slab might also change. Therefore, the part of returns going towards taxes may not be the same, as estimated today. Therefore, ensure you account for a provision such as this in your financial planning.

For example – Equity Mutual Fund’s long-term returns were not taxable in past but now they are (returns exceeding 1 Lakh.). This can happen to any investment. A provision for such expenditure needs to be kept while planning.

Taking investment risks to make money is very common but when it comes to creating a fund to deliver certain liability, one should be cautious. High returns always come with high risks. This aspect shall never be overlooked. The certainty level of the fund is very important and hence, look for long-term consistency rather than short-term gains. Build up some provisions to handle the uncertainty factor.

Conclusion –

A child’s education is one of the major liabilities parents have. In the event of poor planning, the additional financial burden forces us to compromise on a child’s future or to sacrifice other future financial goals. Although availing of education loans could also be an alternate course of action, timely action can prevent this. Judicious planning can help out overcoming most of the surprises helping to pursue a child his dream education.

All Rights Reserved By ManishMantra.com